- Services

- Events, News & Research

- Events, News & Research

- Social Action & Research Centre

- Social Action and Research Centre

- The poker machine card. Simple as.

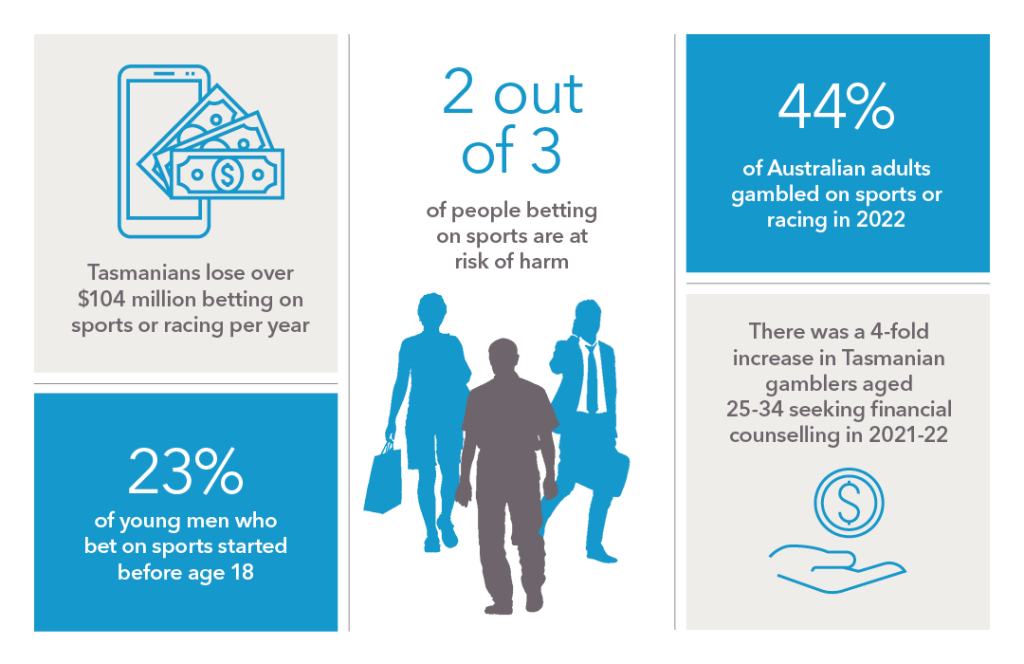

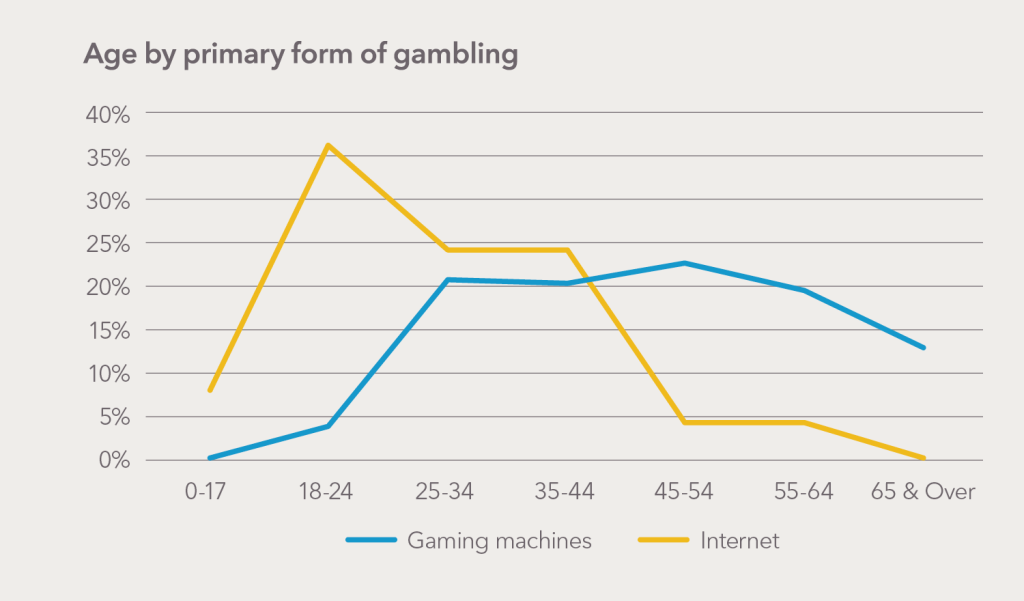

- Gambling Research – What’s the Real Cost?

- Action for a healthier community: An effective response to illicit drugs

- Financial Wellbeing Research – Buy Now Struggle Later

- Rental Affordability Snapshot

- Unaccompanied Homeless Children in Tasmania

- Young, in love and in danger

- About Us

- Careers

- Contact Us

Call us 1800 243 232

Menu

Call us 1800 243 232

- Services

- Events, News & Research

- Events, News & Research

- Social Action & Research Centre

- Social Action and Research Centre

- The poker machine card. Simple as.

- Gambling Research – What’s the Real Cost?

- Action for a healthier community: An effective response to illicit drugs

- Financial Wellbeing Research – Buy Now Struggle Later

- Rental Affordability Snapshot

- Unaccompanied Homeless Children in Tasmania

- Young, in love and in danger

- About Us

- Careers

- Contact Us